Your guide to tech-driven changes in the media landscape by IPG Media Lab. A fast read for you and a forward for your clients and team.

- Apple released SDKs for iMessage, Siri, and Maps, allowing brands to integrate with those three platforms at the core of the iPhone experience

- Apple Pay will work on mobile and desktop in Safari, allowing brands to create a seamless shopping experience, and will support third-party Watch apps

- iOS 10 will add 3D-touch support and rich interactions to notifications, continuing a trend toward more powerful notifications

What Apple Announced

Apple kicked off its annual Worldwide Developer Conference (WWDC) yesterday in San Francisco with a jam-packed, two-hour keynote presentation. For a summary of the announcements that Apple made today, TechCrunch has a great summary. The announcements from the opening keynote that are relevant to brands and marketers include:

- Apple Pay – including loyalty cards and coupons – now works with third-party Watch apps as well as on the web in Safari, which will make checkout seamless on both desktop and mobile.

- The Messages app receives a massive makeover in iOS 10, gaining a more animated interface and tons of fun new features. Most importantly, Apple is introducing an App Store for iMessage, turning their messaging app into a platform that can be extended by developers and brands. These apps can be bundled with a full-fledged iOS app or they can be distributed independently.

- Apple Maps in iOS 10 launches Map Extensions for developers to integrate services such as restaurant booking or ride hailing right into Maps

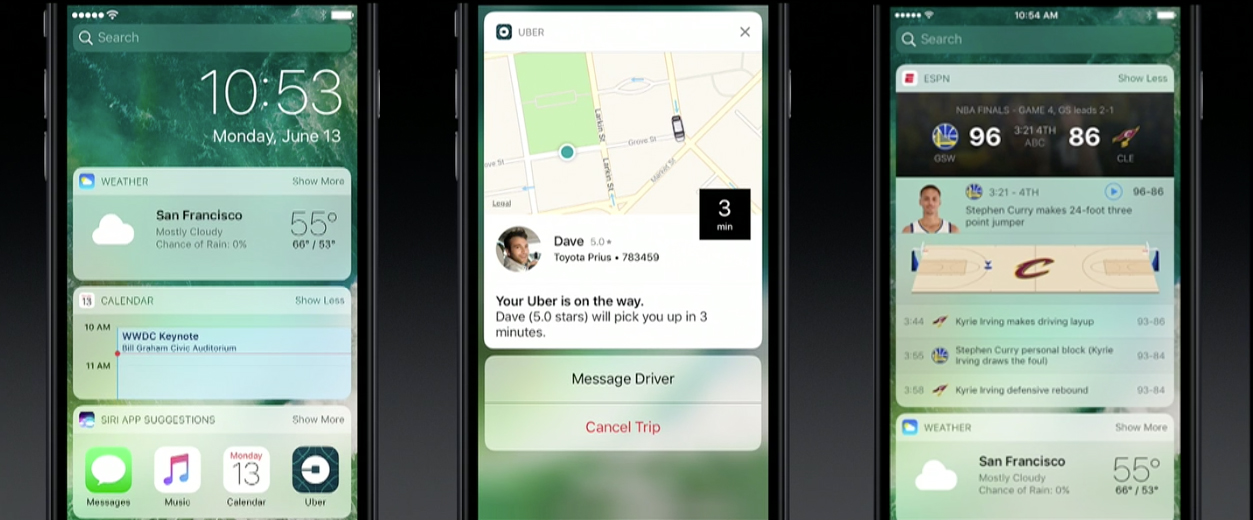

- Siri SDK allows Siri to perform actions in third-party apps in supported domains, including messaging, ride-sharing, photo search, and payments via apps like Square Cash and AliPay.

- Siri search in the new tvOS for Apple TV will include YouTube results, allowing brands to get in front of more people by partnering with YouTube creators.

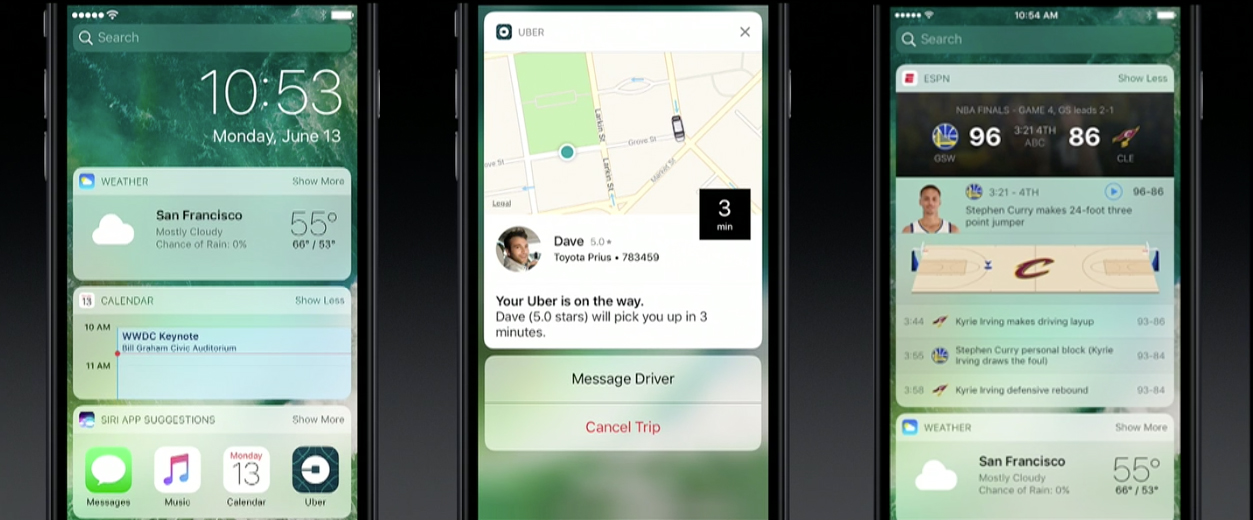

- iOS 10 beefs up notifications with rich interactions and 3D Touch support.

What Brands Need To Do

What Brands Need To Do

As iOS 10 introduces news ways to increase user engagement with apps by helping the system suggest your app to users at appropriate times, it is paramount that brands make sure to properly index their app content so that users can access in-app content and services through Spotlight, web search results, and Siri suggestions. Brands should make sure the locations and amenities of owned or partner stores, hotels, and restaurants are properly indexed for Siri so that users can easily access the information they need.

Between new rich notifications, Siri support for some types of apps, and widgets becoming available on the iOS lock screen, Apple has begun unbundling the app-centric model it helped create. Though these features are all delivered and supported by an installed app, it’s increasingly possible for users to never have to open the app itself to accomplish a task. Brands will have to work with developers to ensure their branded apps support these new features to maximize engagement.

For any brand that sells directly to consumers online, especially those in the retail and fashion industries, the updates for Apple Pay spell exciting new opportunities to create a frictionless shopping experience across devices. The new Safari integration allows customers shopping on brands’ websites to easily check out using Apple Pay on mobile browsers and, thanks to the Continuity feature in the new macOS, on their Mac devices as well. And the API allows brands to integrate Apple Pay into their Watch apps to provide a seamless purchase experience.

How We Can Help

Please contact Client Services Director Samantha Holland ([email protected]) at the IPG Media Lab if you would like more detail or want to schedule a visit to the Lab to discuss how your brand may benefit from integrating with Apple’s ecosystem, particularly in messaging and in the living room with Apple TV.

For previous editions of Fast Forward, please visit ipglab.com. Please reply with any constructive criticism or feedback. We want these to be as useful as possible for you and your clients, and your input will help us immensely.

What Brands Need To Do

What Brands Need To Do