With over 150 million monthly users, live-streaming platform Twitch unlocks massive audience potential for brands. Essentially a community-driven ESPN for gaming (though its offerings go far beyond), Twitch has the largest attention share of any online platform behind Netflix— and by far the largest scale of any live video platform.

Brands have been slow to adopt Twitch, owing to its gaming-centric audience and innovative live-streaming approach. However, now that apps such as Meerkat and Periscope are household names, Twitch needs to be added to the conversation that television and online video have occupied for years.

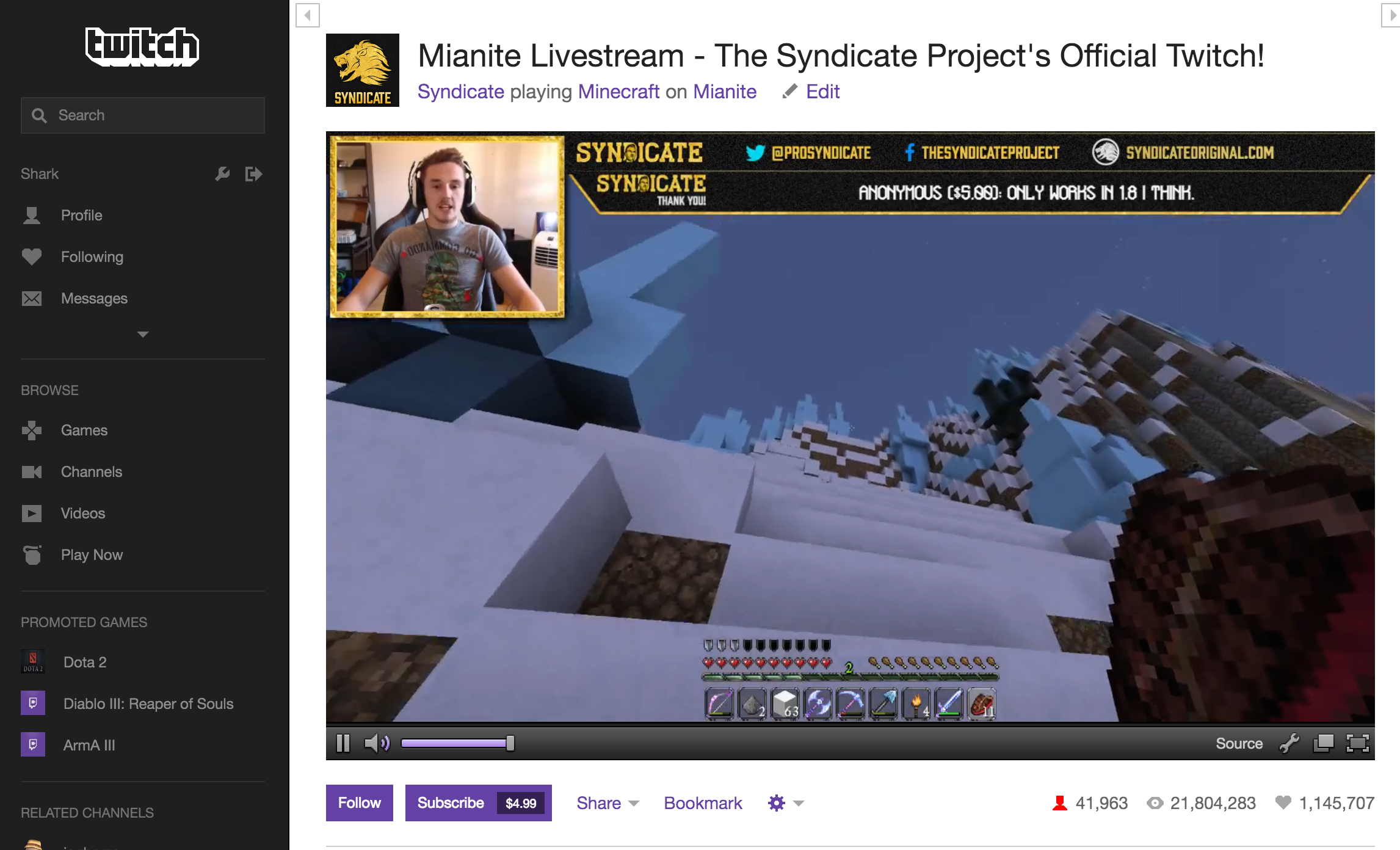

What is Twitch, and why do so many users visit it?

Twitch emerged from Justin.tv (one of the first live-streaming destinations online) when its creators realized gaming companies were, uniquely among content owners, actually in favor of users streaming their content. Fast-forward to last year, when Amazon purchased the network for nearly $1 billion.

How did that happen? It turns out gamers really, really like watching and sharing video games. Twitch essentially pioneered an entirely new user behavior, and millions of visitors joined in. The platform became known as the most comprehensive destination for the gaming community, including user gaming videos, e-sports tournaments, electronic music, and more.

Twitch has totally upended the way gamers consume content, but is diversifying into other areas as well. This month, HBO will air the pilot of its “Silicon Valley” property on Twitch before the new season premieres, and host Q&A sessions with the cast. Twitch is also pursuing premium relationships in music, film, and poker.

What should I know about Twitch’s audience?

150 million global users visit the platform monthly, with 6.9 million uniques daily. As its audience is so massive (and enduring — the average consumption is over 100 minutes per person, per day), Twitch represents an entirely new channel to reach young, male consumers in particular. Although gaming is at the core, Twitch’s offering goes far beyond, and the platform should be considered as a network in itself.

How can brands use Twitch?

Twitch is employing innovative advertising solutions: the company offers traditional activations (display and video inventory), but also native advertising and sponsorship (activations with its highly developed influencer network, sponsorship of e-Sports events, and social engagement).

Examples of native activations include the 7UP-sponsored Twitch stream of Ultra Music Festival, and a Mountain Dew platform takeover, which garnered 8.5 million views over six days. Along with HBO, Discovery has launched a property on Twitch and YouTube. Labels such as Rhymesayers have uploaded music on the site’s growing streaming library. And while an April Fool’s Day channel of Darude’s inane “Sandstorm” playing nonstop may not be so interesting, the 10,000 followers gained in that one day speaks to its centrality as a platform.

Image courtesy of Twitch