As mobile usage continues to rise, mobile spending is correspondingly increasing, growing 42% annually over a four-year period. Therefore, it is important for brands looking to conquer the mobile space to understand how and when average users are making purchases on mobile devices and hopefully discover some behavioral patterns that can help inform brands’ mobile commerce strategy.

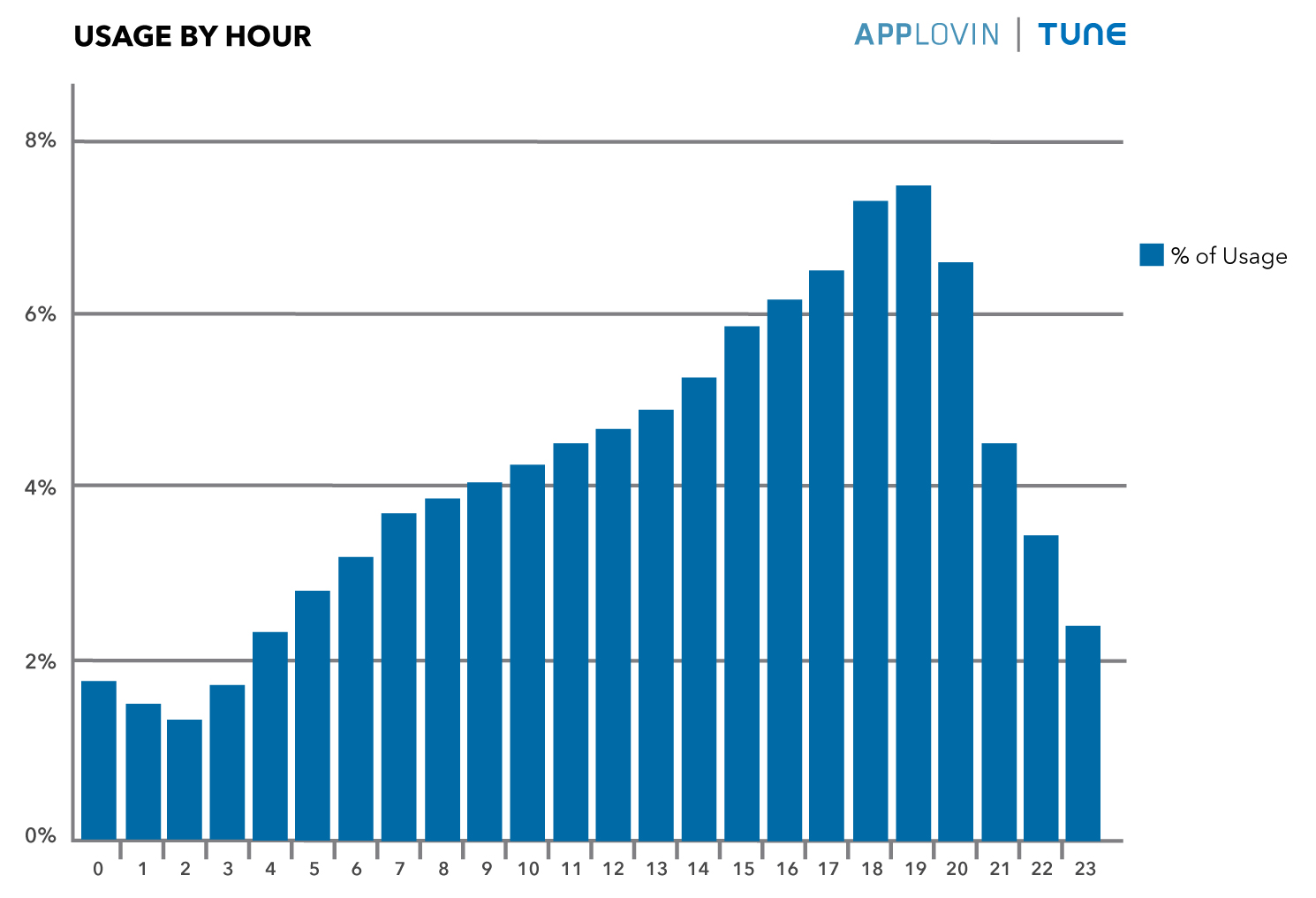

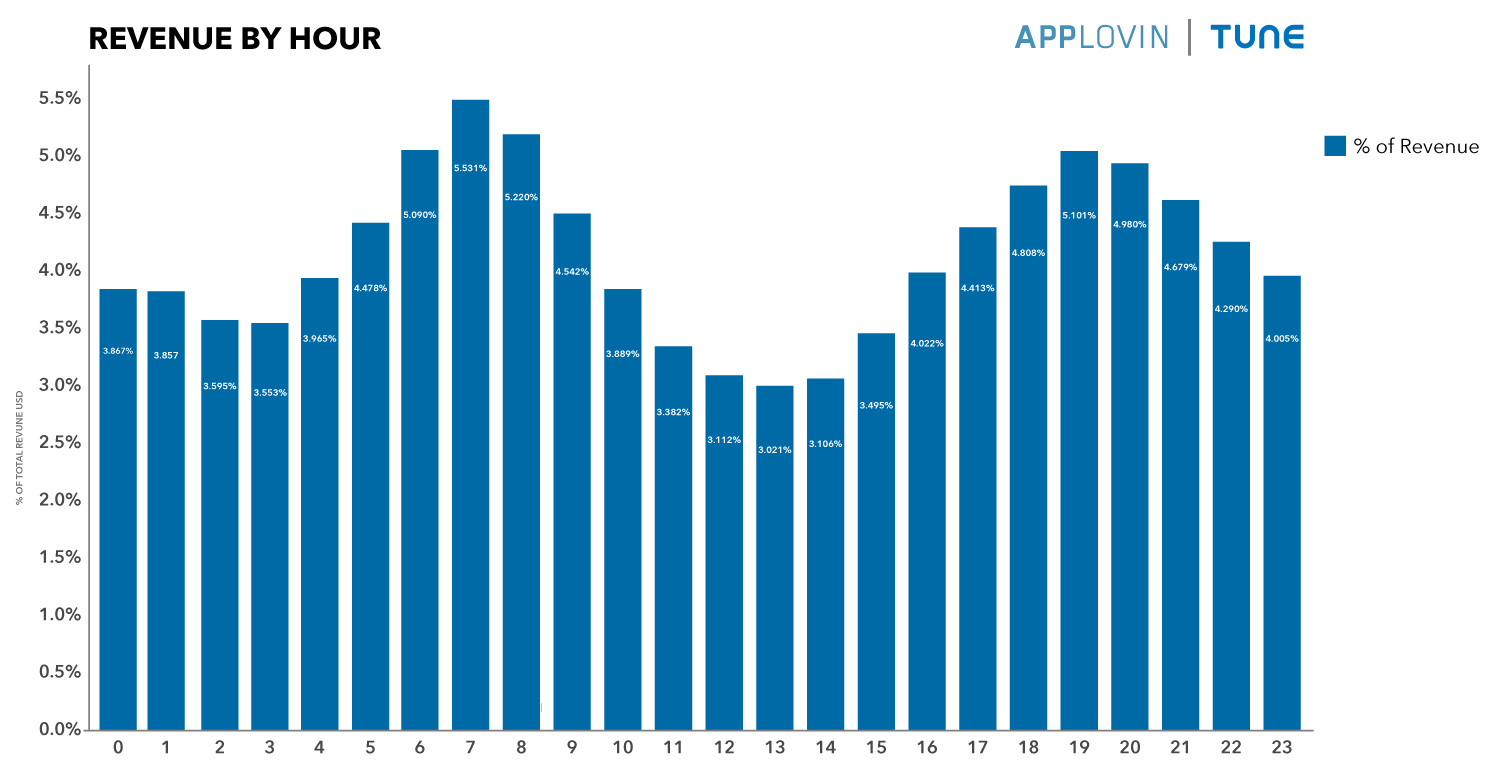

Whether in games, retail, travel or other commerce apps, users are much more likely to make purchases before and after work, according to a study from AppLovin and TUNE. The study found that, on an hourly basis, mobile revenues and usage spikes to a daily high around both 7 a.m. and 7 p.m. during weekdays, discrediting the myth of “lunch break shopping”.

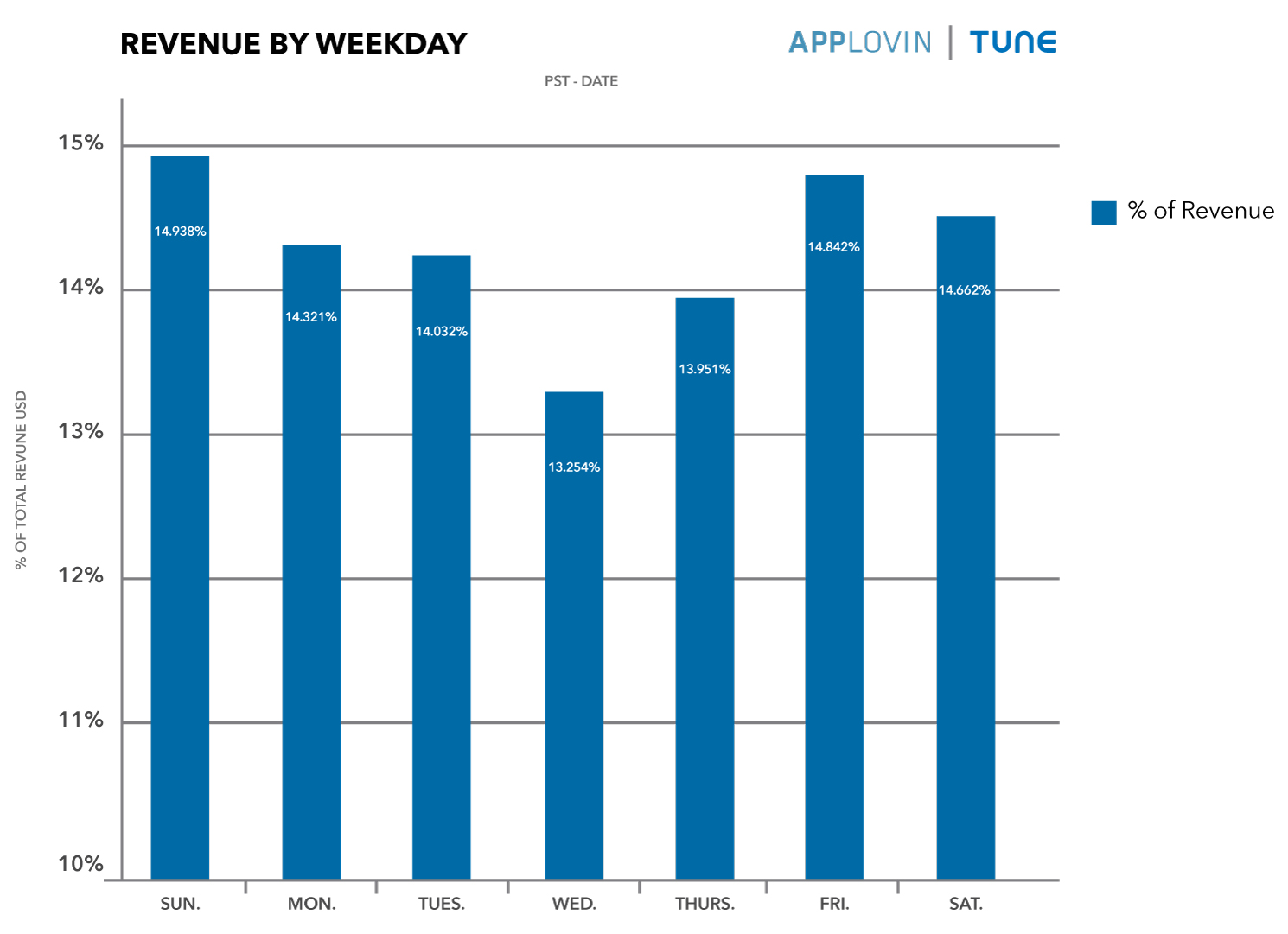

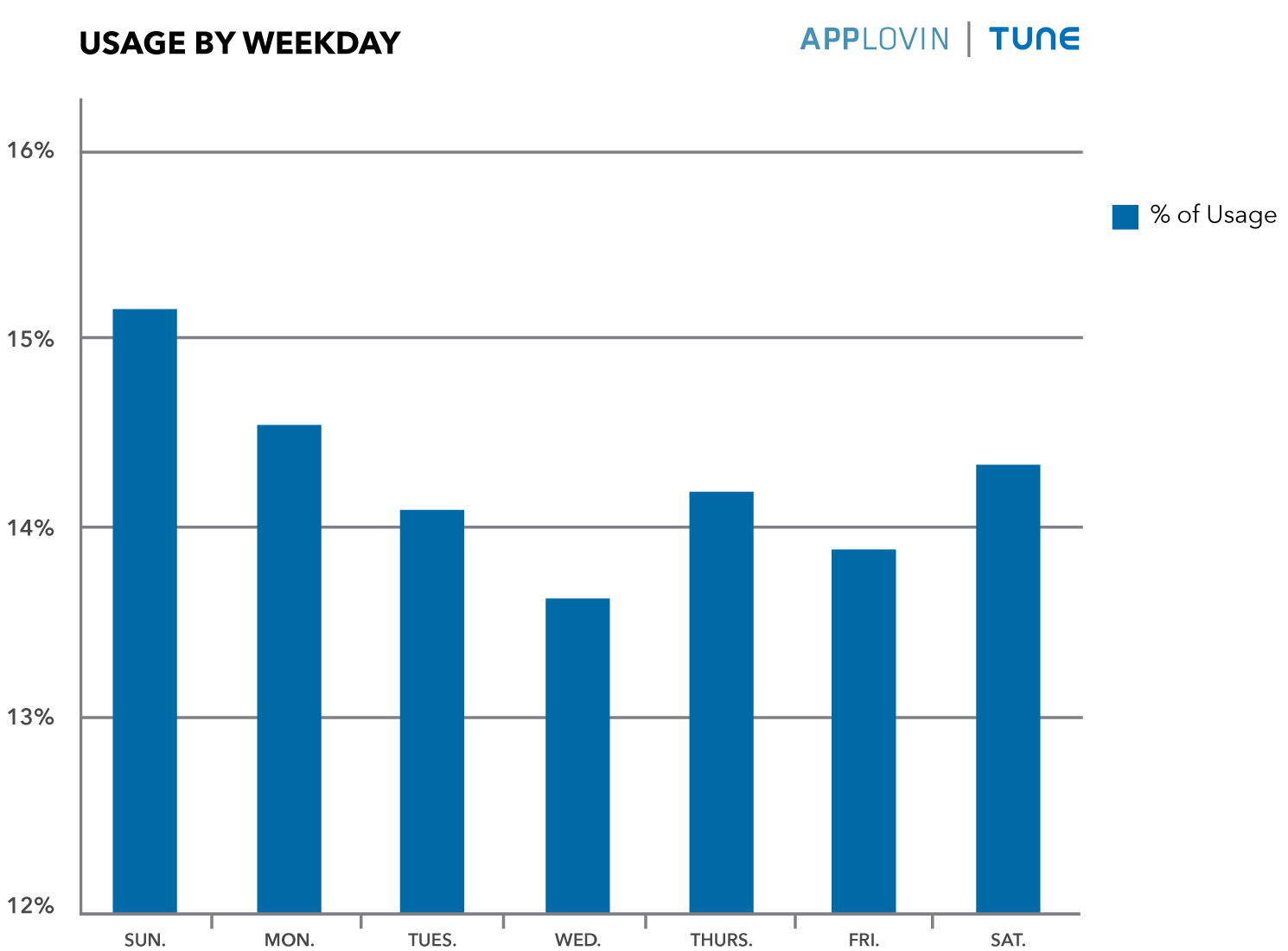

Similarly, on a day-to-day basis, mobile spending peaks over weekends, while Wednesday marks the lowest. Although it is generally established that Mondays are generally the best revenue for online retail, Fridays and Sundays take the top spots for most in-app purchasing and spending.

It is also important to note that mobile spending revenue pattern doesn’t necessarily correlate to mobile usage. While Wednesdays, the lowest day in terms of revenue, do register the lowest mobile usage of the week, Friday, second slowest day in terms of usage, is also the second highest in terms of revenue.

Likewise, on an hourly basis, evening is when usage and spending both hit their daily peaks, whereas the morning hours post similar spending but less usage. The bottom line here is mobile commerce is not the same as general ecommerce, and marketers need to find ways to programmatically increase win rates during peak hours and weekends that fit the mobile spending patterns.

All featured charts courtesy of AppLovin Blog.