What Happened

Snapchat has made significant progress in its ad business this year, including launching an Ad API last month and partnering with several third-party analytics firms to help improve its ad measurement. Last week, Digiday reported that the company has reduced the pricing of its ads bought through its ad API from a previous minimum of $500,000 per ad to just $100,000.

Meanwhile, comScore released on Monday a report that contains some interesting stats about Snapchat’s user demographic. According to its estimation, 14% of U.S. smartphone users that are 35 or older are now using Snapchat, up from a mere 2% three years ago. For smartphone users aged 25 to 34, that number has ballooned from 5% to nearly 38% in the past three years.

What Brands Need To Do

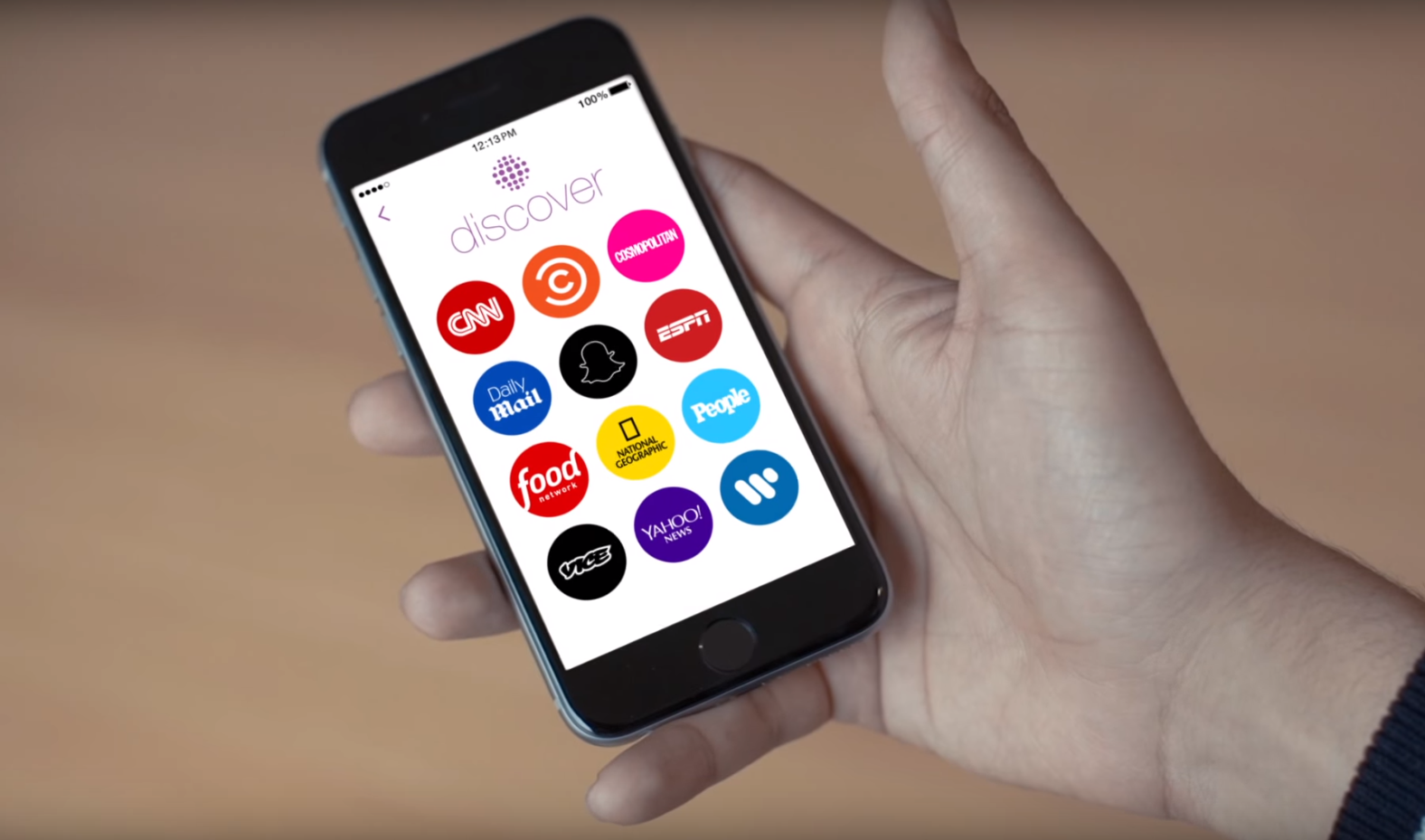

When it first opened up to brand advertisers in late 2014, Snapchat received some flak for its formidably high pricing and lack of transparency on ad performance. Now as the social app continues to mature and attract a more diverse user base, its ad business has evolved accordingly and become more accessible and measurable. The expanding user demographic points to new opportunities for marketers to reach a wider audience. For brands that are looking to connect with mobile users, Snapchat is a fast-growing social channel that marketers should not overlook.